Turn International Payments

Into Banking Revenue Opportunities

Automate international wire processes, lower FX rates, and grow non-interest income through correspondent banking technology.

Pre-integrated with Fiserv PX, Aptys, Braid, and other leading payment platforms

Contact us

Let's talk about how to automate your international wire processes and bring in new revenue with no technical lift.

200+

Financial institutions use our technology

$1 billion+

International payments processed annually

5X

Revenue from USD wire conversion

Global Payments, Local Profits

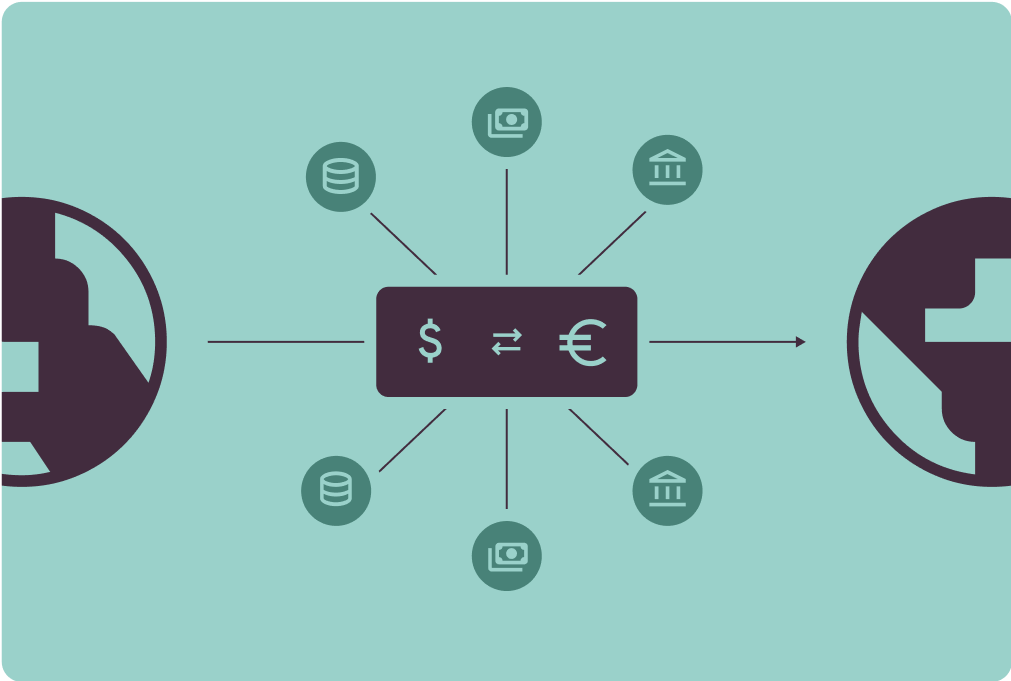

Acceleron’s FX marketplace and currency conversion engine helps community banking institutions to leverage their international wire volume and tap into non-interest income.

Automate International Wire Processes

Utilize API technology to catch errors upfront and perform speedy end-to-end data transfers.

Pre-Integrated with Fiserv Payments Exchange

Bring FX services in-house and increase non-interest income without expanding staff. Our international payment automation solutions are pre-integrated with Fiserv Payments Exchange, Aptys, Braid, and other leading payment platforms, which means implementation requires no additional development work and the path to more revenue starts in days.

Drive Down FX Prices

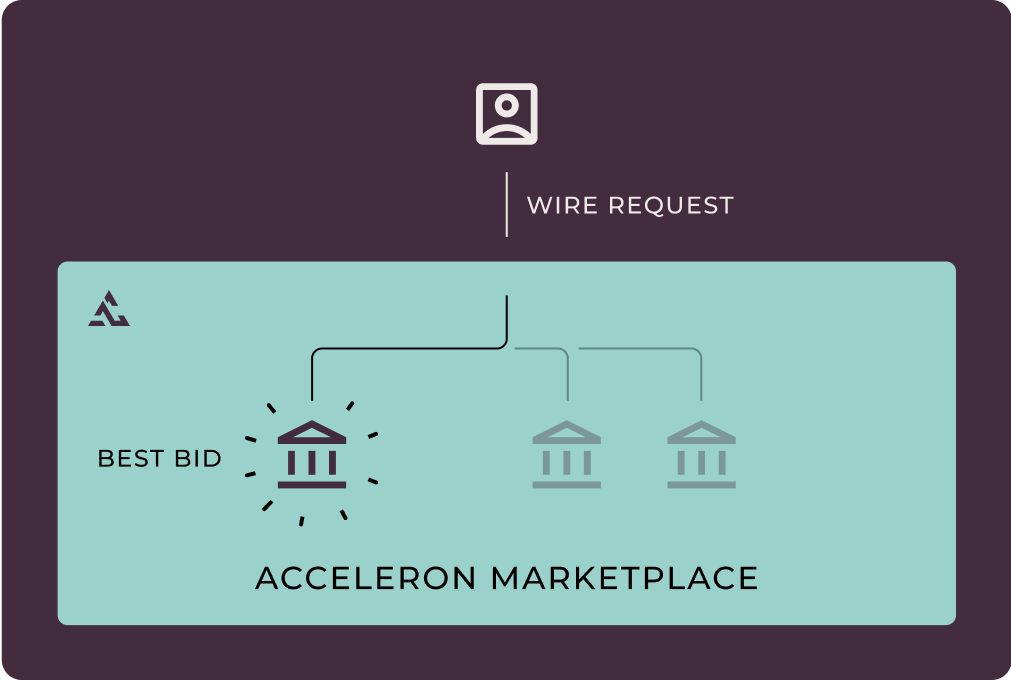

Leverage a competitive FX marketplace where multiple correspondent banks bid for your transactions, driving down costs and maximizing revenue on every transfer.

Capture Foreign Exchange Fees

Incentivize customers to convert USD wires to FX wires and start earning instantly on international transactions by capturing foreign exchange fees alongside wire fees.

Learn more →

Serve More Customers

Expand your customer base by accessing multiple correspondent banks with more diverse appetites through our FX marketplace to build redundancy and ensure business continuity.

Learn more →

Smarter International Payments Automation

Acceleron’s advanced API streamlines wires processing end-to-end, reducing manual entry, errors, and delays.

Built-in validations flag issues instantly, ensuring faster, cleaner transactions.

Read the latest blog articles

3 min read

The Exchange Newsletter - February 2026

Feb 20, 2026

7 min read

Community Banking News Update: Bank-Fintech Acquisitions, Credit Union Tax, SBA Eligibility Changes - February 2026

Feb 12, 2026

Talk to an Expert

200+ banks are using Acceleron to:

-

Automate wire transfers

-

Reduce costs

-

Earn non-interest income

-

Build redundancy

.png?width=688&height=532&name=Convert%20Wires%20in%20Real%20Time%20(1).png)

.png)