Innovation in correspondent banking technology means less manual entry and errors, more time savings and revenue.

Key Takeaways

- New software technology can automate international wire processes, significantly reducing manual entry and errors.

- An FX marketplace leverages competitive bidding to secure better exchange rates, driving down costs for banks and customers.

- Currency conversion tools offer community banks a valuable opportunity to enhance revenue potential through additional fee capture.

Sending international wires the traditional way often means community banks miss out on valuable revenue opportunities. That’s because the most lucrative part of the transaction, the currency conversion, is performed by the foreign banks at the end destination, leaving your institution with little more than the wire fees. However, new software technologies present smarter ways to handle international wires. By automating the wire process and converting currencies upfront, community banks can streamline operations while retaining profits from foreign exchange fees.

In this article, we’ll explore how an FX marketplace operates, the automation tools that drive efficiency, and new user interfaces to encourage your customers to choose FX wires over USD to save money and have transparency into how much money is actually being sent.

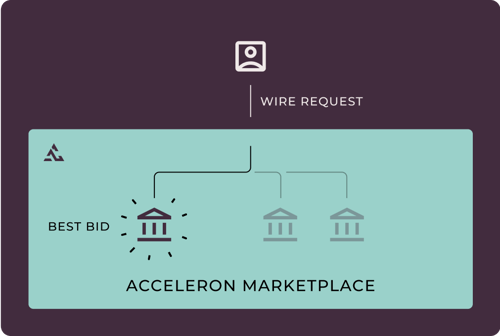

What is a correspondent banking marketplace?

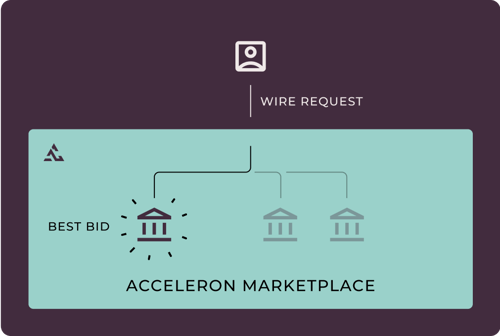

A correspondent banking marketplace offers banks the best pricing on international wires. When an international wire is initiated in an FX marketplace, multiple correspondent banks submit bids on the exchange rate. The best rate is returned in seconds. This competitive environment allows banks to offer more attractive pricing to customers.

Acceleron has developed two FX tools to help community banks compete with big banks in international payments: an FX marketplace, known as SmartRoute, and a newly patented customer interface system called NudgeConvert which incentivizes customers to convert their USD wires into FX wires to save money. By converting wires upfront, banks can capture not only the standard wire fees but also lucrative foreign exchange fees, creating a dual income stream that enhances overall profitability.

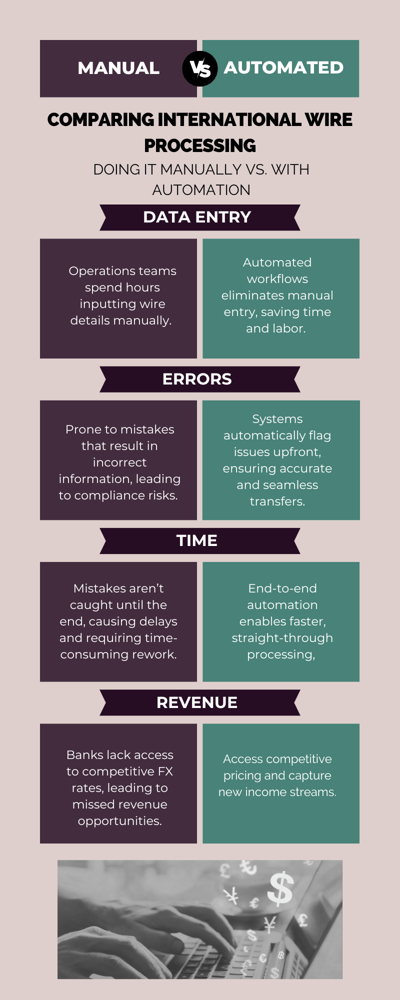

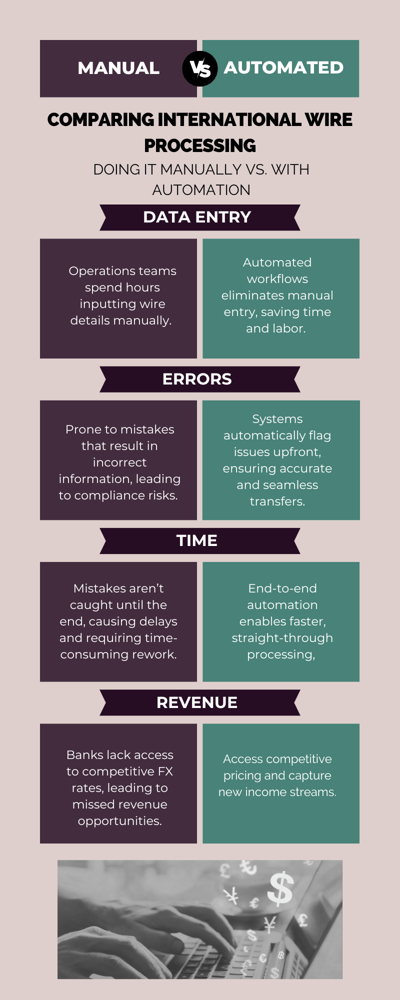

Here are some pointers about the advantages of wire automation and what straight through processing solves:

Smartroute FX marketplace: sending a wire

To send an FX wire, enter the transaction information. SmartRoute automatically sends the request to its marketplace, where multiple correspondent banks bid on the exchange rate. The best available rate is returned within seconds.

After confirming the rate is acceptable, the wire is sent directly to the receiving bank. Your operations team no longer needs to manually enter transactions into a correspondent bank’s system. Instead, data flows seamlessly from start to finish, reducing manual work, minimizing errors, and preventing delays.

Automated validations during the input process ensure that all necessary information is complete before the transaction is processed. This proactive approach minimizes the risk of errors and avoids the common frustration of delays caused by missing or incorrect information.

SmartRoute's automated processes

When a transaction enters the SmartRoute system, it undergoes several automated checks to ensure everything is in order:

- Destination Country Requirements: SmartRoute checks the destination country’s specific requirements, such as the need for a transit code for Canadian dollar transactions. If any required information is missing, the system immediately prompts the user, preventing delays later in the process. Many systems wait until the delivery step before they detect missing information. Nobody wants a call 2 days later asking for what’s required!

- FX Provider Compatibility: The system automatically narrows down the list of FX providers that can handle the selected currency and country, ensuring that only those capable of processing the transaction participate in the rate auction. Once we've identified providers capable of delivering the payment, we request exchange rates from them instantly via API. We then present only the best available rate, which can be locked in — typically for up to 24 hours. Additionally, the system matches you with correspondent banks that are open to working with a wider range of businesses, offering diverse risk appetites to better suit your specific transaction needs.

- Risk Management: For higher-risk transactions, SmartRoute can exclude certain FX providers from the auction, protecting your bank’s relationships and avoiding potential de-risking issues.

- Transaction Information Validation: SmartRoute ensures that all required fields are populated before the transaction proceeds. The data is encrypted from the moment it’s received until it’s sent to the winning provider, and any non-public personal information (NPPI) is deleted immediately after processing to maintain security.

Reconciliation process

At a designated time each day, Acceleron sends a statement summarizing all processed transactions. Each FX provider also sends a statement, independent of Acceleron. If the number of transactions and amounts match, your institution settles with each FX provider. This reconciliation step is crucial for maintaining security and preventing unauthorized transactions.

NudgeConvert: converting FX payments

NudgeConvert is a customer-facing interface designed to encourage the use of foreign exchange payments instead of USD. When a customer initiates a USD wire to a country like Germany, NudgeConvert informs them of the benefits of sending the payment in the local currency — Euros in this case. This not only ensures that the customer knows the exact amount of the transaction upfront, but it also allows your bank to capture the foreign exchange fees, turning a routine wire transfer into a revenue-generating opportunity.

Behind the scenes, NudgeConvert is powered by an anonymized database that identifies whether the beneficiary’s account is in the local currency or USD. If it’s in USD, the system refrains from sending a nudge to avoid unnecessary prompts.

To prevent customer fatigue, NudgeConvert also allows users to stop the prompts for specific beneficiaries by providing a reason. This ensures that only those interested in FX payments receive nudges, avoiding the risk of over-communication.

NudgeConvert is highly customizable, allowing you to tailor it based on currencies, countries, amounts, originators, and more.

.png?width=500&height=337&name=Customer%20Base%20(1).png)

Wire automation side-by-side comparison

See the clear difference automation makes in international payments. From reducing errors to scaling operations, this side-by-side comparison shows how automation transforms your workflow.

I'm interested in wire automation - how can I learn more?

If automation sounds like a good fit for your financial institution, reach out to us directly. We can work with you to deliver a customized solution that meets your specific needs. Even if you’re not integrated with Payments Exchange, our team can conduct a discovery process to find the best way to serve your bank’s wire needs.

In an increasingly globalized financial landscape, the ability to efficiently manage international wire transfers while capturing additional revenue streams is critical for banks. Acceleron’s SmartRoute and NudgeConvert solutions provide a powerful combination of automation, competitive pricing, and customer-focused incentives that help banks optimize their wire processes and maximize profitability. By using these tools, your bank can better serve a wider customer base, streamline operations, and stay ahead of the competition in the evolving world of international payments.

Acceleron builds cutting-edge software that allows community banks and credit unions to conduct international payment transactions profitably through a foreign exchange (FX) marketplace. Serving over 160 institutions and facilitating more than $1 billion in international payments annually, Acceleron helps small banks generate non-interest income and compete more effectively with high-fee big banks. Our solutions integrate seamlessly with top payment platforms, ensuring quick implementation and smooth operation.

Explore how Acceleron's FX Marketplace can enhance your bank's resilience and profitability. Contact us to schedule a meeting.

Damon Magnuski, CEO, Acceleron

Damon Magnuski, CEO, Acceleron

.png?width=500&height=337&name=Customer%20Base%20(1).png)