Leveraging international payments and FX marketplaces to drive non-interest income

Key takeaways:

-

Diversify Income: Non-interest income, especially from international payments, is crucial for stabilizing and boosting bank profitability.

-

Tap Global Growth: With cross-border payments set to hit $250 trillion by 2027, banks can capitalize on this expanding market.

-

Optimize Transactions: Smart technology like Acceleron’s SmartRoute can help banks streamline international payments, increasing automation and fee income.

In today’s volatile interest rate environment, net interest margins (NIM) are constantly under pressure and a top concern to community bankers. NIM has been shrinking for many institutions due to fluctuating rates and increased competition. As a result, banks are seeking alternative revenue sources to stabilize their earnings. Non-interest income — derived from fees, service charges, and commissions — provides a vital buffer against these challenges, allowing banks to maintain profitability even when interest margins tighten.

For community banks, one of the most promising avenues for generating non-interest income lies in the growing field of international payments. By facilitating international transactions and deriving fees, community banks can tap into new revenue streams without relying on the uncertain income generated from loans.

In this article, we will delve into different sources of non-interest income. We will also discuss how community banks can leverage cutting-edge technology in international payments to unlock new opportunities for fee-based income.

What is non-interest income?

Non-interest income refers to the revenue that banks earn from sources other than interest on loans. This income comes from fees, commissions, and other types of financial services. It’s a crucial component of a bank's overall profitability, as it provides a steady stream of revenue regardless of interest rate fluctuations.

Common sources of non-interest income include:

- Service Fees: Charges for account maintenance, overdrafts, ATM usage, wire transfers, and other banking services.

- Transaction Fees: Fees associated with processing payments, such as credit card transactions, debit card transactions, and electronic funds transfers.

- Wealth Management and Advisory Services: Fees from providing investment advice, managing assets, and offering retirement planning services.

- Insurance Products: Commissions from selling insurance products like life, health, and property insurance.

- Foreign Exchange Services: Income from currency exchange services, particularly in international banking operations.

- Trading and Investment Income: Profits from trading activities, including stocks, bonds, and derivatives.

Why is non-interest income important?

Non-interest income offers several key advantages that make it an essential component of a bank's revenue strategy. One of the primary benefits is the diversification of revenue. By generating income from a variety of sources beyond traditional lending activities, banks can reduce their dependence on interest rate movements. This diversification helps to buffer the institution against fluctuations in the market, ensuring a more consistent flow of revenue even during periods of economic uncertainty.

Another crucial advantage is the stability that non-interest income provides. Unlike interest income, which is heavily influenced by economic cycles and shifts in interest rates, non-interest income is generally more predictable. Services such as fees, commissions, and foreign exchange transactions tend to remain stable regardless of broader economic conditions, offering banks a reliable income stream that can help smooth out earnings volatility.

Finally, non-interest income contributes significantly to enhanced profitability. Many of the services that generate non-interest income, such as foreign exchange and other fee-based offerings, come with high profit margins. These services not only bolster the bottom line but also provide banks with the financial flexibility to invest in new opportunities and innovations.

How Can International Payments Help Boost Non-Interest Income?

While other methods of generating non-interest income can be effective, one of the most significant areas of opportunity lies in international payments. As global commerce continues to expand, the demand for seamless and efficient cross-border transactions is growing exponentially. According to the Bank of England, the value of global cross-border payments is projected to surge from nearly $150 trillion in 2017 to over $250 trillion by 2027, underscoring the immense potential in this sector. This explosive growth provides banks with a unique opportunity to capitalize on the rising volume of international transactions and establish themselves as key facilitators of global trade.

Capturing FX Income Through Real-Time Currency Conversion

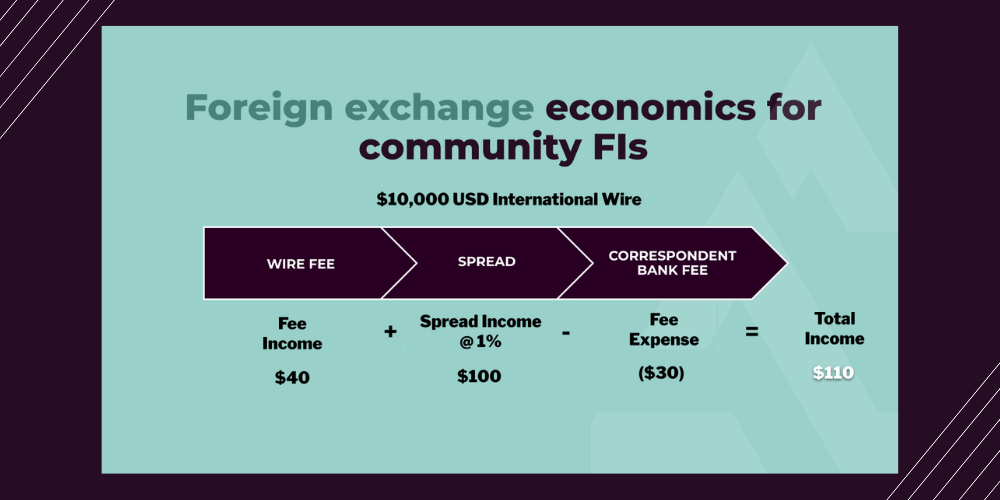

One of the most impactful ways banks can increase non-interest income is by leveraging real-time currency conversion tools, such as Acceleron’s NudgeConvert, to generate foreign exchange (FX) fees. These tools allow banks to take a fee on the spread of a foreign exchange transaction by converting the currency upfront during the wire process. By doing so, banks not only secure their standard wire fees but also capture additional revenue from FX spreads.

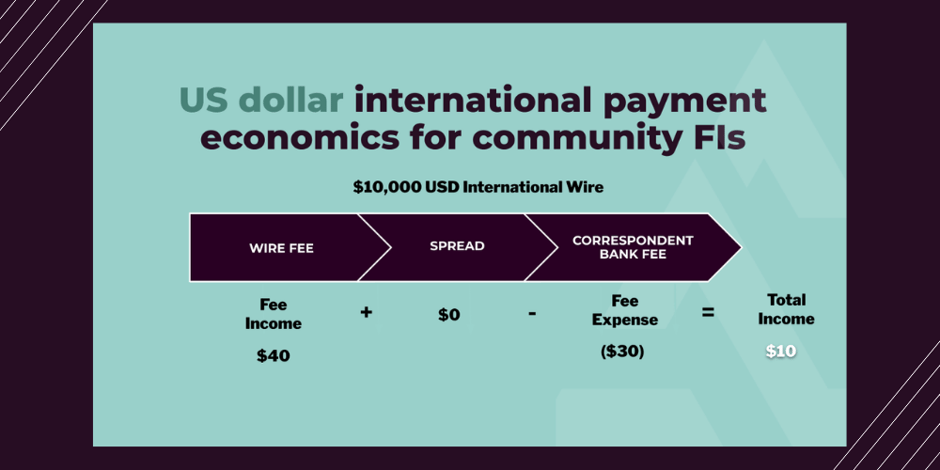

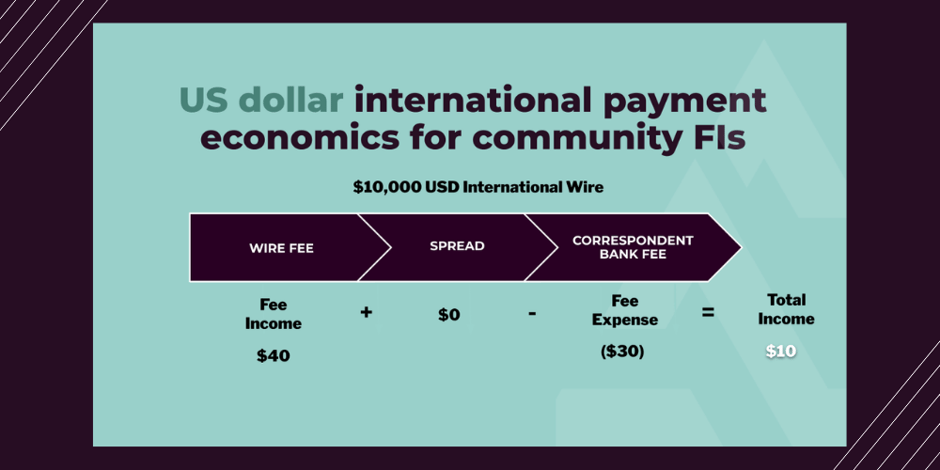

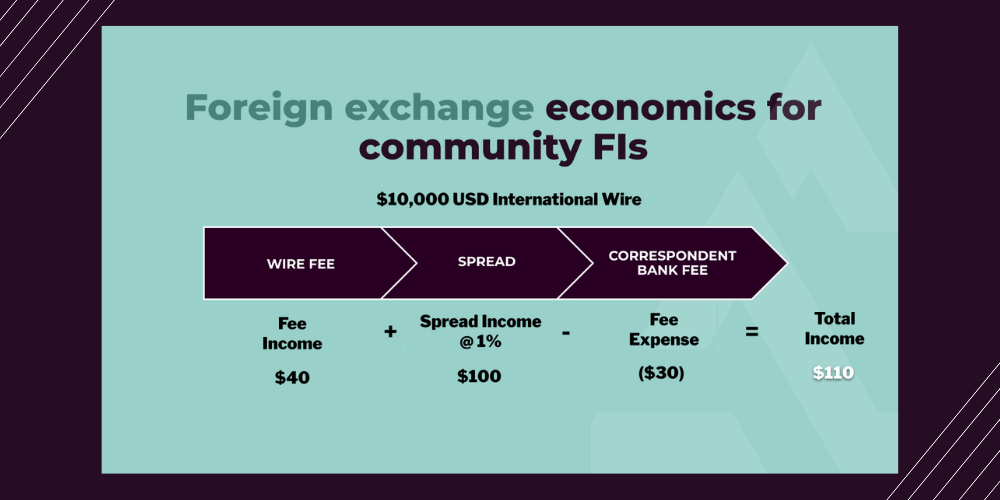

Acceleron CEO Damon Magnuski breaks it down to the dollar:

NudgeConvert’s real-time capabilities ensure that the conversion happens instantly, providing transparency and competitive rates for customers while maximizing profitability for the bank. This approach not only enhances the bank’s bottom line but also strengthens its value proposition as a provider of cost-effective, efficient international payment solutions. Here is a comparison of the difference between processing USD wires and FX wires:

The FX Marketplace Advantage

Beyond tools like NudgeConvert, participating in an FX marketplace offers another powerful way to boost non-interest income. In this competitive environment, multiple banks bid on foreign exchange rates, ensuring the most favorable rates prevail. This system allows banks to:

- Offer Competitive FX Rates: By delivering attractive foreign exchange rates, banks can attract and retain more customers.

- Generate Fee Income: Banks capture both transaction fees and FX margins from each converted payment.

- Streamline Operations: Advanced technology automates processes, reducing manual intervention and saving time and money.

Acceleron’s FX marketplace seamlessly integrates with Fiserv Payments Exchange, Braid and other major payment platforms. That means the implementation requires no tech lift and no additional staff. Through its intelligent routing capabilities, transactions are directed to an auction where correspondent banks compete, driving costs down for customers and increasing fee capture for banks.

In addition, wire process automation cuts down on manual entry, reducing errors and delays. Read more about correspondent banking automation:

Non-interest income is an essential component of a bank's revenue stream, offering stability and diversification in a volatile economic climate. By optimizing services such as digital banking, wealth management, payment processing, and insurance offerings, banks can not only enhance their non-interest income but also provide greater value to their customers. International payments stand out as a particularly lucrative opportunity. With global cross-border payments expected to grow, banks that strategically leverage this growth through innovative technology like FX marketplaces can unlock significant new revenue streams and be better positioned for sustained growth and profitability.

Acceleron builds cutting-edge software that allows community banks and credit unions to conduct international payment transactions profitably through a foreign exchange (FX) marketplace. Serving over 160 institutions and facilitating more than $1 billion in international payments annually, Acceleron helps small banks generate non-interest income and compete more effectively with high-fee big banks. Our solutions integrate seamlessly with top payment platforms, ensuring quick implementation and smooth operation.

Explore how Acceleron's FX Marketplace can enhance your bank's resilience and profitability. Contact us to schedule a meeting.

Andrew Dillard, Chief Business Officer, Acceleron

Andrew Dillard, Chief Business Officer, Acceleron

-1.png)