The Exchange Newsletter - February 2026

This month's must-knows on bank charter momentum, ISO 20022 friction, and modern correspondent banking strategy As we move into 2026, it feels like...

3 min read

Daisy Lin, Head of Marketing, Acceleron

:

9/25/24 9:26 AM

Daisy Lin, Head of Marketing, Acceleron

:

9/25/24 9:26 AM

From its humble beginnings starting with $300 and a handful of officers, Service Credit Union (Service CU) has grown into a global financial powerhouse, providing a lifeline for military personnel and their families. Originally founded in 1957 to offer affordable credit to airmen at what was then Pease Air Force Base in New Hampshire, Service CU now serves hundreds of thousands of members all over the world. Service CU operates more than 50 walk-in locations and offers 24/7 access through online and mobile banking.

In recent years, Service CU wanted to upgrade its international payments processing capabilities. For military families stationed abroad, the ability to transfer funds quickly and seamlessly is essential, and Service CU was determined to find a solution that would keep these transactions running smoothly. Enter Acceleron, whose correspondent banking software provided the answer.

In 2020, Service CU recognized the need to change vendors in its international payments processing to better serve its members, particularly those stationed overseas in places such as Germany. As more members began relying on seamless and faster transactions, Service CU sought a partner capable of a quick integration into their existing infrastructure.

“Acceleron provided us with a life raft,” said Cyndi Graniello, Assistant Vice President at Service Credit Union. “Military families depend on us to ensure their rent, utilities, and daily living expenses are paid.”

Service CU needed a reliable and efficient solution that could scale with their growing needs while maintaining the high standards their members had come to expect. That’s when they turned to Acceleron, whose correspondent banking software offered the swift onboarding and better customer service Service CU needed to keep payments flowing smoothly.

Acceleron stepped in to help Service CU maintain and upgrade its international payments processing. With its innovative correspondent banking software, Acceleron enabled Service CU to streamline the flow of funds for military families stationed overseas, ensuring there were no disruptions in service.

“Working with Acceleron is fantastic. They are extremely responsive,” Graniello explains. “Foreign payments used to take forever and you kind of just hoped and prayed it would get there. And now through these technologies we're making it more accessible.”

Read more about international wires automation:

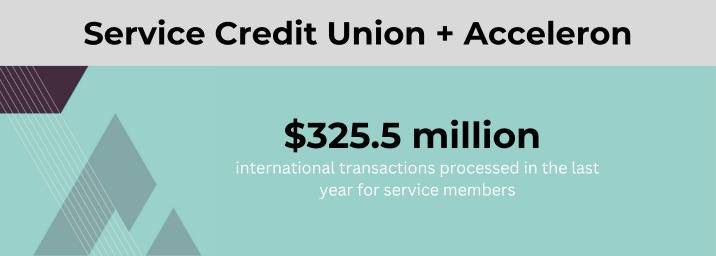

With Acceleron now handling SCU’s international payment transactions, the credit union has processed an increasing amount of transactions for military families. In the last year, SCU and Acceleron facilitated more than $325.5 million in international funds.

FX Automation Leveling the Playing Field

Advancements in technology and automation have given credit unions like Service CU the ability to offer international payment services that were once exclusive to larger banks.

“Technology has leveled the playing field in a big way,” Graniello explains. “More and more credit unions and community banks are adding foreign payments and getting access to technologies as they become accessible. Some of the barriers have been taken down, and they’re taking that opportunity.”

For example, Acceleron’s pre-integration with major payments platforms removes much of the technical burden, allowing community banks and credit unions to quickly adopt the system without extensive additional work, enabling fast and seamless implementation.

With the success of the initial partnership, SCU and Acceleron are already discussing what’s next. “We’re working with Acceleron to figure out how we can enhance the system,” Graniello explains. “We’ve had such positive experiences with them so far, and now we’re looking at ways to offer even more services, such as inbound wires and improved foreign exchange rate negotiations through the FX marketplace.”

All of these efforts highlight SCU’s strong commitment to advancing their international payments capabilities.

“We're bringing some applications into the cloud and laying the groundwork for us to expand the relationship," Graniello says. "I can call Acceleron anytime there's a problem and know that I’ll receive personalized attention, as they truly care about their customers and the overall quality of the service."

Acceleron builds cutting-edge software that allows community banks and credit unions to conduct international payment transactions profitably through a foreign exchange (FX) marketplace. Serving over 160 institutions and facilitating more than $1 billion in international payments annually, Acceleron helps small banks generate non-interest income and compete more effectively with high-fee big banks. Our solutions integrate seamlessly with top payment providers, ensuring quick implementation and smooth operation.

Explore how Acceleron's FX Marketplace can enhance your bank's resilience and profitability. Contact us to schedule a meeting.

This month's must-knows on bank charter momentum, ISO 20022 friction, and modern correspondent banking strategy As we move into 2026, it feels like...

Key regulatory, policy, and market shifts community banks and credit unions should be watching These are extraordinary times for the banking...

Common international wire failure points and how international payment automation can reduce errors to under 1% In 1871, Western Union introduced...