Powerful forces are shaking the foundation of correspondent banking.

While global opportunities for cross-border payments continue to expand, the ability to service these transactions is shrinking due to the persistent challenge of de-risking, where correspondent banks terminate business relationships to avoid risk. Here’s the irony — even as trillions of dollars in international payments flow through the system every year, entire regions like the Pacific Islands faced isolation in 2024 as banks severed ties, leaving them cut off from the global financial network.

At the heart of the year’s developments in correspondent banking are efforts to combat de-risking, harness emerging technologies, and prepare for transformative regulatory milestones like the ISO 20022 compliance deadline. These changes hold significant implications for community banks, which must adapt to thrive in an increasingly complex financial landscape. Here’s a closer look at the recent developments and what lies ahead.

Take a look at the latest Year-In-Review:

Global Expansion of Cross-Border Payment Systems

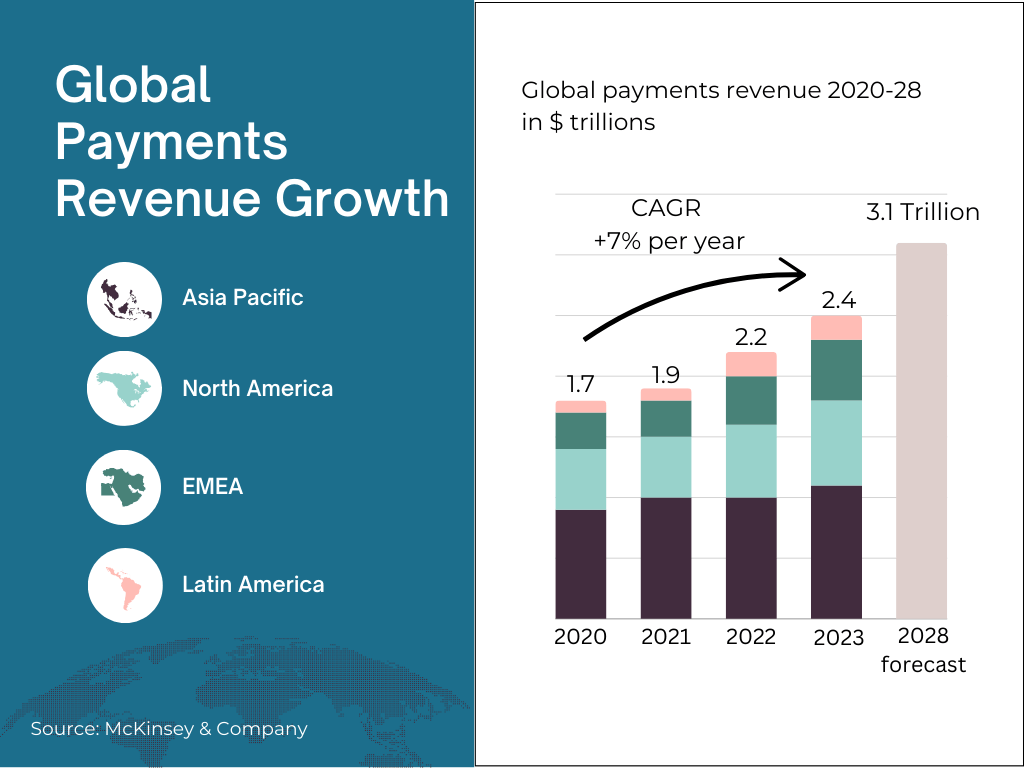

The global payments industry grew 7 percent annually from 2018-2023 and will grow 5% per year over the next few years, bringing in an additional $700 billion of revenue for a total of $3.1 trillion by the end of 2028, according to McKinsey.

In 2024, cross-border payments saw significant innovation worldwide, enhancing speed, efficiency, and connectivity.

- Europe: Spain became the first market fully integrated with the European Payments Council's instant payments plan, enabling seamless cross-border transactions across the region.

- Asia: Vietnam expanded QR payment interoperability with China, Japan, and South Korea, while India advanced its payment connections with neighboring nations, including the UAE.

- Africa: The Pan-African Payment and Settlement System (PAPSS) accelerated regional payment connectivity, reducing costs and boosting trade.

- Latin America: The Central Reserve Bank of Peru formed a strategic partnership with the National Payments Corporation of India (NCPI) to develop an instant payment system similar to that of the Unified Payments Interface (UPI) in India.

- North America: The Federal Reserve is collaborating on Project Agorá, a Bank for International Settlements initiative focused on integrating tokenized central bank and commercial bank money onto a single platform. In Canada, the Bank of Canada (BoC) has outlined plans to roll out a real-time payments system within the next two to three years in an effort to modernize the nation's financial system.

For community banks, these advancements highlight opportunities to offer customers faster, more competitive global payment solutions, reinforcing the need to stay informed and invest in modern payment infrastructures.

De-Risking: A Persistent Challenge

De-risking, the practice of financial institutions scaling back or terminating correspondent banking relationships (CBRs), dominated the headlines. Large banks, grappling with regulatory pressures and rising compliance costs, reduced their CBRs, impacting smaller institutions and high-risk regions disproportionately.

Impact:

- Pacific Island nations were severely affected, as they depend heavily on CBRs for cross-border payments, remittances, and trade finance.

- Community banks in the U.S. also felt the strain, as de-risking limited their ability to support international payments for their customers, particularly small businesses.

The Response: In response to de-risking’s global consequences, the World Bank approved a $68 million support program for Pacific Island nations. This initiative ensured continued access to cross-border payments even in regions at risk of losing all correspondent banking relationships. For Pacific nations, this means that remittance flows — vital economic lifelines — will be preserved, protecting their economies from further strain.

Additionally, the Pacific Banking Forum, co-hosted by the U.S. and Australia in July, brought stakeholders together to explore solutions that balance the need for regulatory compliance with the imperative of maintaining global financial connectivity. During the forum, Australia pledged additional funding to support banking services in the Pacific, reinforcing its commitment to preserving financial inclusion and stability in the region.

The broader implications of de-risking also resonate with U.S. community banks, which face challenges in maintaining international payment services. These parallels highlight the urgency of building resilience and redundancy into banking operations to mitigate the risks associated with de-risking.

Read our article on the importance of working with multiple correspondent banks to ensure business continuity and cost savings.

Correspondent Banking Technological Innovation Leads the Way

In 2024, technological advancements reshaped correspondent banking, addressing longstanding inefficiencies and unlocking new opportunities for banks to streamline their operations. These innovations are particularly significant for community banks and credit unions, offering solutions to challenges that have historically constrained smaller institutions.

Key Innovations:

- Regtech for Compliance: Regulatory technology (regtech) tools have emerged as game-changers, simplifying compliance with Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) regulations. By automating complex regulatory tasks, these tools reduce the burden on smaller institutions and enhance accuracy.

- Wire Automation: While emerging technologies like digital currencies hold promise for cross-border payments, they remain nascent and inaccessible for most financial institutions. International wires continue to be the backbone of global transactions. Solutions like Acceleron’s FX marketplace are transforming wire processing by automating manual tasks, catching errors early, eliminating delays, and enhancing accuracy. This automation enables community banks and credit unions to deliver faster, more reliable services to their customers while streamlining operations.

For community banks and credit unions, embracing these technological advancements is key to earning non-interest income, and with pre-integration into major payment platforms, development work is minimal. To learn more about how correspondent banking technology can transform your institution, check out our article:

ISO 20022: The Countdown to November 2025

One of the most pressing issues for community banks is the upcoming ISO 20022 compliance deadline in November 2025. This global standard for financial messaging will modernize how cross-border payments are processed, replacing outdated systems with a richer, data-driven framework.

What community banks and credit unions need to know:

- Opportunities: ISO 20022 enables faster, more efficient payment processing, better tracking, and increased transparency.

- Challenges: Transitioning to the new standard requires significant investment in infrastructure, systems integration, and staff training.

- Urgency: Community banks that fail to meet the deadline risk being left behind, as correspondent banks and payment networks adopt the standard globally.

While the transition to ISO 20022 may present logistical and financial challenges, the long-term benefits far outweigh the initial hurdles. Adopting this standard empowers community banks to compete more effectively in a global marketplace, offering seamless international payment experiences that align with the demands of modern customers. Beyond compliance, ISO 20022 positions banks to harness rich payment data for insights, innovation, and enhanced decision-making. By acting now, community banks not only avoid disruption but also unlock new growth opportunities that solidify their relevance and competitive edge.

What Lies Ahead for Correspondent Banking

As 2025 approaches, correspondent banking is on the brink of significant transformation. The ISO 20022 compliance deadline in November 2025 will dominate strategic planning, with early adopters expected to gain a competitive edge by leveraging the enhanced data capabilities and operational efficiencies the standard offers. Efforts to mitigate de-risking will continue to shape global banking policies, with a focus on ensuring financial inclusion and preserving vital cross-border connections for smaller and vulnerable economies. Meanwhile, technology is set to be a defining factor in the industry's evolution, as regtech and automation play an increasingly critical role in improving compliance, streamlining processes, and addressing longstanding inefficiencies. These trends underscore the need for banks, particularly community banks, to proactively adapt and innovate to remain relevant and competitive in an increasingly interconnected world. Stay updated with breaking developments in correspondent banking on our news updates page.

Acceleron builds patented software that allows community banks and credit unions to conduct international payment transactions profitably through a correspondent banking marketplace. Serving over 200 financial institutions and facilitating more than $1 billion in international payments annually, Acceleron helps small banks generate non-interest income and compete more effectively with high-fee big banks. Our solutions integrate seamlessly with top payments platforms, ensuring quick implementation and smooth operation.

Subscribe to our monthly newsletter, "The Exchange," to stay ahead of the curve and get original content you won't find anywhere else!

Daisy Lin, Head of Marketing, Acceleron

Daisy Lin, Head of Marketing, Acceleron

-1.png)