This month’s new developments in cross-border payments and correspondent banking.

In this month’s Global Correspondent Banking Monitor, we examine the latest shifts in cross-border payments and correspondent banking worldwide. This edition covers Ripple’s regulatory milestone in Dubai, SEPA’s expansion to Moldova and North Macedonia, and Brazil’s push for a blockchain-based BRICS payment system. We also cover major fintech-bank collaborations, including Best Buy Canada’s partnership with PingPong, Citibank’s global payroll expansion with Papaya, and BriskPe’s RBI approval for cross-border payments in India. As alternative networks and digital solutions continue to reshape the industry, community banks must consider how to capture these growing opportunities in international payments. Read last month’s issue here.

North America

As global payment volumes grow, businesses are seeking out providers to make cross-border transactions easier. These new partnerships present both challenges and opportunities for community banks.

- Best Buy Canada Partners with PingPong for Cross-Border Payments

Best Buy Canada has selected PingPong Payments to streamline payments to international suppliers, offering a more cost-effective and compliant solution for global transactions.

- Papaya Global and Citibank Expand Global Payroll Payments

Papaya Global has partnered with Citibank to enhance payroll transactions in over 160 countries. This cross-border payment collaboration aims to provide faster and more transparent salary disbursements worldwide.

- Boost Payment Solutions and TransferMate Improve B2B Cross-Border Payments

Boost Payment Solutions and TransferMate are teaming up to offer streamlined B2B payment solutions with enhanced security and compliance. This partnership reflects the growing demand for efficient, business-friendly international transactions.

Correspondent Banking Takeaways

The rapid expansion of global payment partnerships highlights the growing competition for international transactions. Businesses are increasingly looking to fintechs and specialized payment providers to handle cross-border payments, bypassing traditional banks.

Community banks need to stake a claim in this industry by offering competitive international payment services in-house. Instead of ceding this business to new market entrants, banks can integrate FX conversion solutions to retain their customers and secure their share of non-interest income.

Call to Action

🔹 Join Our Free Pilot Program: Acceleron is launching a NudgeConvert pilot program with a select group of community banks and a major payments platform. This revenue-boosting FX technology enables real-time conversion of USD wires to FX wires, increasing revenue potential by up to 5x, while lowering costs for customers. Interested? Contact Acceleron Chief Business Officer Andrew Dillard: andrew@acceleronbank.com

🔹 Learn More About the NudgeConvert pilot program

Latin America

Latin America’s cross-border payments sector is rapidly evolving, with new fintech initiatives and blockchain-based solutions reshaping global transactions.

- XTransfer and Ouribank Partner to Boost Brazil’s Cross-Border Trade

Ouribank, one of Brazil’s leading foreign exchange banks, has entered into partnership with XTransfer, China’s top B2B cross-border trade payments platform, to simplify and reduce the cost of cross-border payments for global traders working in Latin America.

- Brazil Explores Blockchain-Based Payment System for BRICS

The Brazilian government is developing a blockchain-based cross-border payment system among BRICS nations. Brazilian representatives will discuss the proposal at the BRICS summit in July in Rio de Janeiro.

- Uruguay’s Prometeo Introduces Borderless Banking for B2B Payments

Fintech firm Prometeo has launched a new cross-border banking solution to streamline B2B payments between Latin America and the U.S., improving transaction speed, security, and cost-efficiency.

Correspondent Banking Takeaways

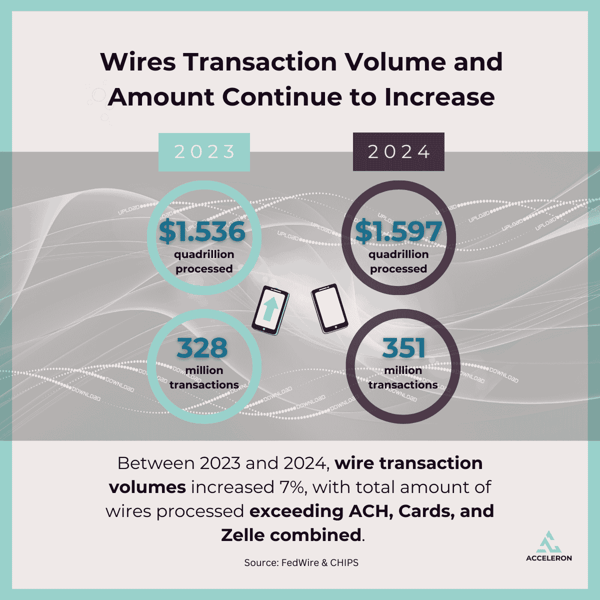

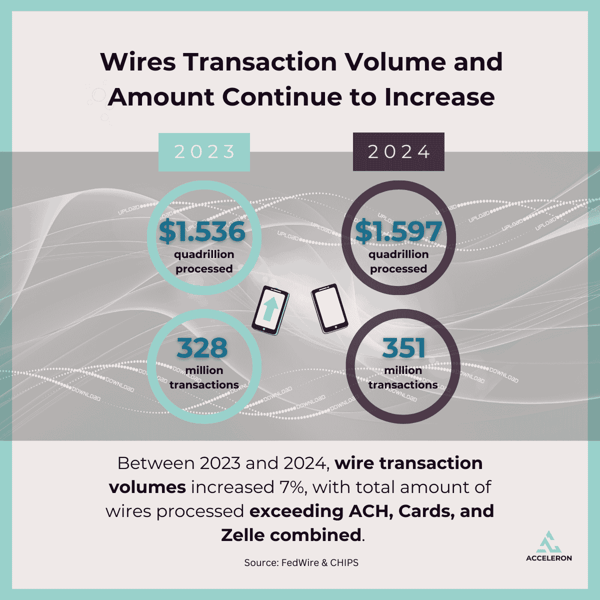

While these emerging partnerships introduce alternative cross-border payment methods — whether through cards or new payment rails — wire transfers remain the foundation of global payments, moving more value than any other method. Just how significant are wire transfers? The transaction volumes for 2024 compared to 2023 tell a compelling story. 📊

Businesses are actively seeking faster and more cost-effective ways to move money internationally. This presents an opportunity — banks that integrate innovative international payment solutions can deepen customer relationships and capture valuable non-interest income.

Europe

European payment networks continue to expand, reinforcing financial connectivity across borders. The latest development in SEPA (Single Euro Payments Area) integration points to the region’s push for more seamless and efficient international transactions.

- North Macedonia and Moldova Join SEPA Payment Network

North Macedonia and Moldova have officially joined the SEPA payment network, marking a significant milestone in their financial integration with the European payments system. By joining SEPA, businesses and consumers in these countries can now benefit from faster, more cost-effective euro transactions for intra-European payments. This expansion, along with the EU’s recent mandate for instant payments, reflects Europe’s ongoing efforts to simplify cross-border payments within the broader European market.

Correspondent Banking Takeaways

For community banks, SEPA’s expansion underscores the growing expectation for fast, transparent, and low-cost international payments. Customers increasingly demand seamless cross-border transactions, and if their primary bank doesn’t offer competitive international payment services, they’ll look elsewhere. By integrating efficient international payment solutions — such as real-time FX conversion and streamlined wire processing — community banks can retain and grow business relationships while generating additional non-interest income.

Read our article on how community banks can increase non-interest income through international payments:

Middle East

The United Arab Emirates (UAE) continues to position itself as a global hub for financial innovation, with blockchain-based cross-border payments gaining regulatory support.

- Ripple Becomes First Blockchain Firm with Dubai Regulatory Approval for Cross-Border Payments

Dubai’s Financial Services Authority (DFSA) has granted U.S.-based digital payments Ripple full approval to operate as a licensed blockchain-based payment provider, making it the first blockchain company to receive this level of regulatory clearance. With this approval, Ripple plans to offer cross-border crypto payments in the UAE, leveraging blockchain technology to enhance transaction speed, liquidity, and cost efficiency. This expands Ripple’s footprint in the region, where the cross-border payments market is valued at approximately $40 billion.

Correspondent Banking Takeaways for Community Banks

As more businesses and financial institutions explore crypto-powered payment rails, community banks must consider how they can stay competitive in the evolving payments landscape. Offering seamless, secure, and cost-effective international payment solutions — without ceding business to fintech disruptors — can help community banks retain customers, strengthen relationships, and capture new revenue streams.

Learn more about wire automation to speed up processing and reduce errors:

Asia

As Asia’s digital payments ecosystem continues to expand, global financial institutions are finding new ways to tap into the country’s rapidly growing cross-border transactions market.

- American Express and Alipay Partner to Expand Cross-Border Payment Access in China

American Express has teamed up with Alipay to expand its reach in China’s fast-growing card market, allowing Amex cardholders to add their credit cards to Alipay digital wallets.

- BRISKPE Secures RBI Approval for Cross-Border Transactions

BRISKPE, a fintech specializing in global virtual accounts and payments, has received in-principle approval from the Reserve Bank of India (RBI) to operate as a payment aggregator for cross border (PA-CB) transactions. This approval enables BriskPe to facilitate payments for both exports and imports. With India’s trade volumes rising, the fintech aims to simplify global payments for SMEs.

Correspondent Banking Takeaways

While these digital solutions offer efficiency and convenience, they don’t replace the need for secure, bank-led international payment options — especially for high-value transactions. Community banks should recognize that their business customers are actively engaging in global trade and need trusted, cost-effective solutions for international payments. By providing FX conversion, faster wire transfers, and seamless integration with global payment networks, community banks can retain this business, drive new revenue, and reinforce customer loyalty.

Read our article 5 Biggest Pain Points in International Payments (And What to Do About Them):

Acceleron builds patented software that allows community banks and credit unions to conduct cross-border payment transactions profitably through a foreign exchange marketplace. Serving over 200 financial institutions and facilitating more than $1 billion in international payments annually, Acceleron helps small banks generate non-interest income and compete more effectively with high-fee big banks. Our digital correspondent banking solutions and international payments automation integrate seamlessly with top payments platforms, ensuring quick API integration for banks.

Subscribe to our monthly newsletter, "The Exchange," to stay ahead of the curve and get original content you won't find anywhere else!

Daisy Lin, Head of Marketing, Acceleron

Daisy Lin, Head of Marketing, Acceleron

-1.png)