The Exchange Newsletter - February 2026

This month's must-knows on bank charter momentum, ISO 20022 friction, and modern correspondent banking strategy As we move into 2026, it feels like...

4 min read

Daisy Lin, Head of Marketing, Acceleron

:

2/20/26 9:45 AM

Daisy Lin, Head of Marketing, Acceleron

:

2/20/26 9:45 AM

As we move into 2026, it feels like the banking industry continues to pick up speed.

What was once considered old infrastructure — a bank charter — is suddenly front and center. Payments firms are pursuing approvals. Crypto-adjacent companies are rethinking structure. And established banks are buying fintechs to modernize from within.

At the same time, wire departments across the country are adjusting to ISO 20022 realities. More structured data. More required fields. More compliance rigor. All of it good for transparency, but not always easy on operations.

For community banks and credit unions, the questions are practical:

How do we stay competitive in a shifting charter environment?

How do we manage increasing complexity without adding headcount?

How do we strengthen non-interest income when margins are under pressure?

This month’s newsletter looks at where the market is heading, and what it means for correspondent banking strategy. And just for fun, don't miss our banking meme of the month below! 🐅

The migration to ISO 20022 has enhanced transparency in international wire transfers. Structured fields and standardized messaging improve traceability and compliance.

But enriched data alone does not eliminate friction. Many institutions are experiencing increased complexity within their wire departments. More mandatory fields, formatting requirements, and reconciliation points can mean:

Higher exception volumes

Increased manual review

Greater operational strain

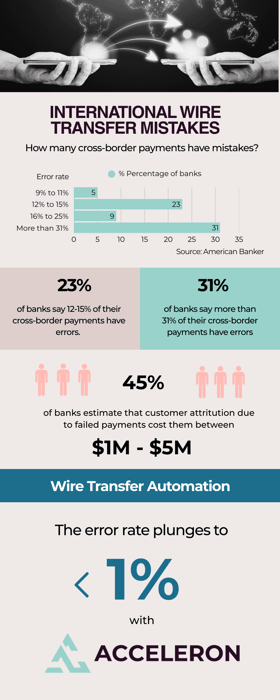

According to Datos Insights research, nearly one-third of banks report double-digit error rates on wire transfers. Failed or delayed payments no only create operational headaches but can result in customer attrition and lost revenue.

The issue is not ISO 20022 itself. The issue is workflow design.

International payment automation changes the dynamic.

Rather than relying on manual review after a wire is submitted, modern systems validate payment instructions in real time before transmission. Required fields are checked upstream. Formatting inconsistencies are flagged immediately.

Acceleron’s correspondent banking platform performs pre-validation within the payment workflow, significantly reducing exception handling and rework. Institutions using automation routinely lower international wire error rates to below one percent.

The impact is measurable:

Fewer investigations

Faster funds availability

Reduced operational costs

Stronger customer retention

Greater opportunity to capture FX revenue

Wire transfer automation is not simply an efficiency upgrade. It is a profitability lever.

Read the full article on how to prevent errors and reduce them to less than 1%.

Every cross-border payment travels through a network of financial institutions. Understanding the distinction between correspondent banks, intermediary banks, and beneficiary banks is essential for community financial institutions seeking better economics and operational control.

Excessive intermediary involvement can increase cost, extend settlement time, and reduce transparency. In many cases, foreign institutions capture the foreign exchange margin while the originating bank handles the operational workload.

Modern correspondent banking models are designed to streamline routing, minimize unnecessary handoffs, and centralize FX pricing. When structured correctly, community banks can retain more of the foreign exchange spread and strengthen non-interest income performance.

Strategic correspondent relationships matter more than ever.

This month’s industry developments reflect ongoing structural change:

Payments firms and crypto players advance bank charter applications

Traditional banks acquire fintechs to modernize core capabilities

Credit union acquisitions face new tax scrutiny in certain states

SBA eligibility standards tighten

Federal Reserve policy debates continue

Regulatory posture, capital strategy, and technology investment are becoming increasingly interconnected.

Not that long ago, bank charters were considered legacy infrastructure. Fast forward to 2026, and there’s a line outside charter offices of all stripes.

The fintechs (Checkout.com, Mercury, Bunq)

The crypto companies (Circle, Ripple, Paxos, BitGo, Erebor, Nubank)

The payments companies (Stripe, Paypal, Affirm)

Why the shift? Because access to insured deposits matters. Control over margins matters. Direct payment rail access matters. Owning the regulatory relationship matters. Infrastructure is the foundation of the whole thing.

At Acceleron, we’ve been on our own multi-year bank charter path for exactly that reason. Not because it’s trendy. Because long-term correspondent banking requires durable structure.

Some institutions are just now joining the line.

We’ve been building for it.

Our objective is to build a correspondent banking platform designed specifically for community financial institutions, combining international payment automation, foreign exchange workflow management, and structured ISO 20022 data handling within a single framework.

Upon receiving a full charter, Acceleron will expand its ability to deliver comprehensive correspondent banking services while maintaining its automation-first architecture.

The goal is straightforward:

Help community banks modernize cross-border payments, mitigate de-risking pressure, and generate sustainable non-interest income from international transactions.

We're here to support you. Let us know what questions we can answer; just DM us with any requests. Enjoyed this edition of The Exchange? Subscribe to get the monthly update. And forward it to a banking buddy — sharing is caring. 😊

Acceleron builds patented software that allows community banks and credit unions to conduct international payment transactions profitably through a foreign exchange (FX) marketplace. Serving over 200 financial institutions and orchestrating more than $1 billion in international payments annually, Acceleron helps small banks generate non-interest income through automation and compete more effectively with high-fee big banks.

If you haven’t already, join the Acceleron community, we’d love to connect with you!

📲 Follow us Stay connected! Follow us on LinkedIn for timely updates, behind-the-scenes videos, and the latest insights hot off the press.

🔖 Bookmark Don’t miss out! Check out the Correspondent Connection magazine for the latest community banking news, in-depth profiles of community banking champions, and our 'Future of Community Banking' series.

💬 Chat with us Have questions about streamlining international wire processes? Let’s talk! Speak with one of our FX experts to discover how new technology can help boost your non-interest income. We’re just a click away: reach out here.

Warm regards, The Acceleron Team

Note: This newsletter is intended for general informational and educational purposes only and does not provide financial services advice. It should not be considered a substitute for professional guidance.

This month's must-knows on bank charter momentum, ISO 20022 friction, and modern correspondent banking strategy As we move into 2026, it feels like...

Key regulatory, policy, and market shifts community banks and credit unions should be watching These are extraordinary times for the banking...

Common international wire failure points and how international payment automation can reduce errors to under 1% In 1871, Western Union introduced...